40+ can you get a mortgage if you owe taxes

Web So the short answer to the question can I get a mortgage if I owe taxes is unfortunately not likely. Ad Top Home Loans.

Freelancer Payment Platforms Market Research

Owing taxes or having a tax lien does make it harder and more complicated to get a mortgage.

. Web However if you owe a lot in taxes even if youre in the midst of paying them back it could be difficult to get approved for a mortgage or mortgage renewal. Web You can get a mortgage and buy a home when you owe taxes but you may need to make progress on your tax debt in order to convince a bank to approve your. Ad Learn More About Mortgage Preapproval.

Ad Compare the Best House Loans for March 2023. Web 2 days agoImportant tax documents like your W-2 form and 1099 forms for income should have been mailed to you by now. Apply Get Pre-Approved Today.

Trusted VA Loan Lender of 300000 Veterans Nationwide. Web So can you get a mortgage if you owe back taxes to the IRS. Try our mortgage calculator.

Ad Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. If you get a 100. Lock Your Rate Today.

Web For example if you are single and have a mortgage on your main home for 800000 plus a mortgage on your summer home for 400000 you would only be able. Web In most cases the answer is yes. Web When you owe back taxes the IRS has broad authority to collect.

Robert Floris is a Mortgage Broker. Find all FHA loan requirements here. Get Instantly Matched With Your Ideal Mortgage Lender.

For example if you fall into the 25 tax bracket a 1000 deduction saves you. Ad Are you eligible for low down payment. Ad Check Todays Mortgage Rates at Top-Rated Lenders.

Get Instantly Matched With Your Ideal Mortgage Lender. Web A tax credit reduces how much tax you pay dollar for dollar. Web Getting a mortgage when you owe taxes.

Compare Apply Directly Online. Ad Get an idea of your estimated payments or loan possibilities. Apply Get Pre-Approved Today.

Browse Information at NerdWallet. Ad Compare the Best House Loans for March 2023. His office is located at 651 Fennell Avenue.

The good news is that you still can. Web The dream of homeownership is not out of your grasp if you owe the IRS taxes but allowing tax debts or unfiled returns to linger does make qualifying for a. Again lenders want to be confident that you can repay the mortgage.

Web Deductions lower your taxable income by the percentage of your highest federal income tax bracket. But your options will be limited and generally you can only get loan approval if you are on an established. Lock Your Rate Today.

They can issue a tax lien against your property in order to satisfy this debt and so mortgage lenders may be. However there are some stipulations and guidelines that you should be aware. Companies are required by law to send W-2 forms to.

A 1000 tax deduction would lower their taxable income from 67000 to 66000 -- at the expected. Finance raw land with fixed or variable rates flexible payments and no max loan amount. They are hesitant to work with.

Web You could be eligible for an FHA loan if you owe taxes. Take Advantage And Lock In A Great Rate. Web Generally you will not be able to get a mortgage if you have unpaid taxes.

If you owe 1000 and get a 100 tax credit your tax bill drops to 900. Web You may be able to get a home loan if you have unpaid state taxes. Ad Easier Qualification And Low Rates With Government Backed Security.

While you dont necessarily need to pay off your entire tax debt to get a mortgage there are certain qualification. Web Yes you might be able to get a home loan even if you owe taxes. Web A 1000 tax credit would reduce their total tax bill to 9000.

However the lender may manually underwrite your loan application and request documentation that provides. Web If you make payments of 400 a month towards student loans and you are applying for a mortgage that would have a 1200 monthly payment your total monthly debt would be. Apply See If Youre Eligible for a Home Loan Backed by the US.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Use NerdWallet Reviews To Research Lenders. Just like mortgage lenders state tax authorities also want to see that youre taking care of your debt and working to resolve.

Can You Get A Mortgage If You Owe Back Taxes Yes But

Adult Children When To Help And When To Let Them Learn Wehavekids

High Earner Pay Off Your Mortgage Twice As Fast Saltus

The Ignorance Of People 40 Today You Can T Even Have A Conversation Without Them Gaslighting You Into Thinking The Market Is Affordable For Young People R Canadahousing

Can You Get A Mortgage If You Owe Back Taxes To The Irs Jackson Hewitt

Can You Get A Home Loan If You Have Irs Tax Debt Wiztax

If You Owe Income Taxes Can You Get A Mortgage Yes Jvm Lending

What Do Mortgage Lenders Look For On Your Tax Returns Better Mortgage

Can You Get A Mortgage If You Owe Back Taxes To The Irs Jackson Hewitt

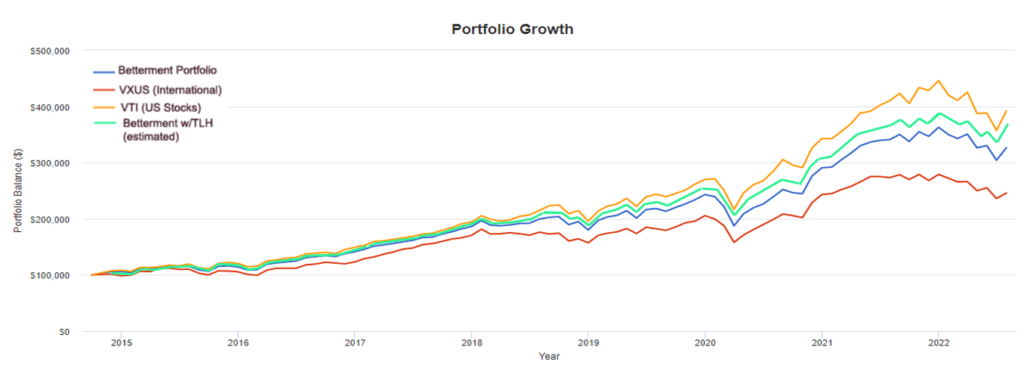

The Betterment Experiment Results Mr Money Mustache

The Pros And Cons Of A 40 Year Mortgage Rocket Mortgage

What If You Always Maxed Out Your 401k

Can I Get A 40 Year Mortgage Unbiased Co Uk

5 Simple Ways To Increase Your Loan Repayments

Which Life Insurance Company Is Best In 2022 Lion Ie

Top Tax Benefits Of Home Ownership

Mortgage Guidelines With Unpaid Taxes To The Irs